Banking has evolved significantly over the past few decades, and one of the most customer-friendly innovations to emerge is the zero balance bank account. If you’ve ever been frustrated by minimum balance requirements or worried about penalty fees eating into your savings, a zero balance account might be exactly what you need. Let’s explore what these accounts are, how they work, and whether they’re the right choice for your financial situation.

What Is a Zero Balance Account?

A zero balance bank account is exactly what it sounds like: a savings or current account that doesn’t require you to maintain any minimum balance. Unlike traditional bank accounts that mandate you keep a certain amount of money in your account at all times, these accounts allow your balance to drop to zero without triggering any penalties or fees.In conventional banking, falling below the required minimum balance often results in charges that can range from modest fees to substantial penalties, depending on your bank and account type. These charges can be particularly burdensome for people who are just starting their financial journey, students managing limited resources, or anyone experiencing temporary financial constraints. Zero balance accounts eliminate this concern entirely, providing financial flexibility without the constant anxiety of maintaining a specific balance.

The Origins and Purpose

Zero balance accounts were introduced as part of broader financial inclusion initiatives in many countries. Governments and financial institutions recognized that traditional minimum balance requirements were creating barriers to banking access for large segments of the population. Low-income individuals, rural communities, and young people entering the workforce often found themselves excluded from the formal banking system simply because they couldn’t meet these requirements.

By removing the minimum balance requirement, banks opened their doors to millions of previously unbanked or underbanked individuals. This democratization of banking services has had profound effects on financial inclusion, allowing more people to save safely, receive direct benefit transfers from governments, build credit histories, and participate more fully in the digital economy.

How Zero Balance Accounts Work

The mechanics of a zero balance account are straightforward. You open the account just as you would any other bank account, providing the necessary identification and documentation. Once opened, you can deposit and withdraw funds as needed, and your balance can fluctuate freely, even dropping to zero, without incurring penalties.

Most zero balance accounts come with basic banking features including a debit card, online banking access, mobile banking applications, and the ability to set up direct deposits or automatic payments. You can typically perform a certain number of transactions per month at no cost, though some banks may limit the number of free ATM withdrawals or impose charges for certain premium services.The account operates on your deposits and withdrawals in real-time, just like a regular account. When you make a purchase with your debit card or withdraw cash from an ATM, the amount is immediately deducted from your available balance. Similarly, when you deposit money or receive a direct transfer, it’s added to your balance right away.

Types of Zero Balance Accounts

While the core concept remains the same, zero balance accounts come in different varieties designed for specific purposes and demographics. Basic savings accounts with zero balance facilities are perhaps the most common, offering a simple way to store money and earn modest interest. Some banks offer these specifically for students, complete with additional benefits like educational loan eligibility or special discounts on banking services.

Senior citizens may have access to zero balance accounts with enhanced features tailored to their needs, such as higher interest rates or preferential treatment for certain services. Salary accounts, which employers use to credit employee wages, often operate as zero balance accounts since the balance naturally fluctuates with monthly deposits and personal expenses.Government-sponsored accounts in various countries, designed to promote financial inclusion among economically disadvantaged populations, frequently operate on a zero balance model. These accounts may come with additional benefits such as accident insurance coverage or overdraft facilities after maintaining a good transaction history.

Advantages of Zero Balance Accounts

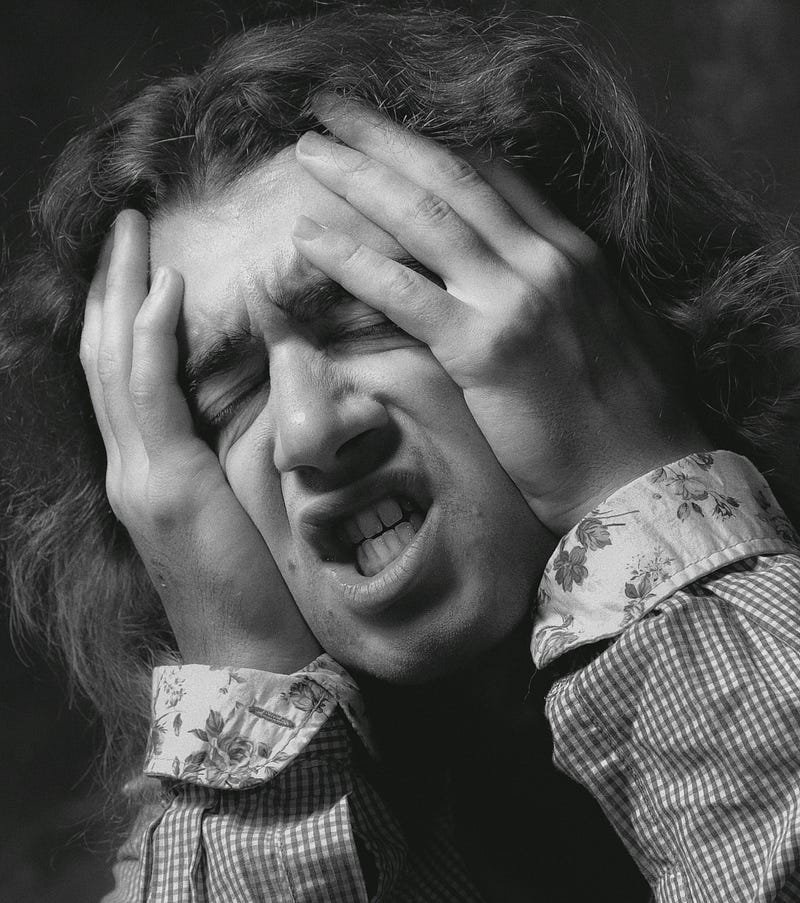

The most obvious benefit is freedom from minimum balance anxiety. You never have to worry about penalty fees draining your account simply because you had an unexpected expense or a lean month. This makes budgeting more predictable and removes an unnecessary source of financial stress.

For people new to formal banking, zero balance accounts provide an accessible entry point. Students, young professionals just starting their careers, or individuals transitioning from informal to formal financial systems can open an account and begin building their banking history without needing a substantial initial deposit.These accounts also serve as excellent tools for financial discipline and planning. Since there’s no pressure to maintain a minimum balance, account holders can save at their own pace, depositing whatever they can afford when they can afford it. This flexibility encourages consistent saving habits without the discouragement that can come from failing to meet arbitrary balance requirements.

Additionally, having a bank account, even a zero balance one, opens doors to other financial services. It establishes your presence in the formal banking system, which can be valuable when you later apply for loans, credit cards, or other financial products. Many banks view a well-maintained zero balance account as evidence of financial responsibility.

Considerations and Limitations

While zero balance accounts offer numerous advantages, they’re not without limitations. Many banks place restrictions on the number of free transactions you can make each month. Exceeding these limits may result in per-transaction fees, which can add up if you’re not paying attention.Interest rates on zero balance savings accounts are sometimes lower than those offered on accounts with minimum balance requirements. Banks view minimum balance accounts as more profitable since they can use that guaranteed capital for lending and investment, and they often share some of that profit with account holders through higher interest rates.Some premium banking services may not be available or may come with additional charges for zero balance account holders. Features like checkbooks, demand drafts, or priority customer service might require fees that are waived for customers maintaining higher balances.

Is a Zero Balance Account Right for You?

The answer depends on your individual financial situation and banking needs. If you’re a student, recent graduate, or someone with irregular income, a zero balance account can provide valuable financial flexibility. If you’re working on building your savings and aren’t ready to commit to maintaining a substantial minimum balance, these accounts offer a stress-free way to participate in formal banking.

However, if you consistently maintain a healthy balance in your accounts and can easily meet minimum balance requirements, you might benefit more from a traditional savings account with higher interest rates and premium features. Similarly, if you make numerous transactions monthly, you’ll want to carefully review the transaction limits on any zero balance account you’re considering.

Zero balance accounts represent an important step toward inclusive banking, removing barriers that once kept millions of people outside the formal financial system. Whether you’re taking your first steps into banking or simply seeking a more flexible account option, understanding how these accounts work empowers you to make informed decisions about managing your money.