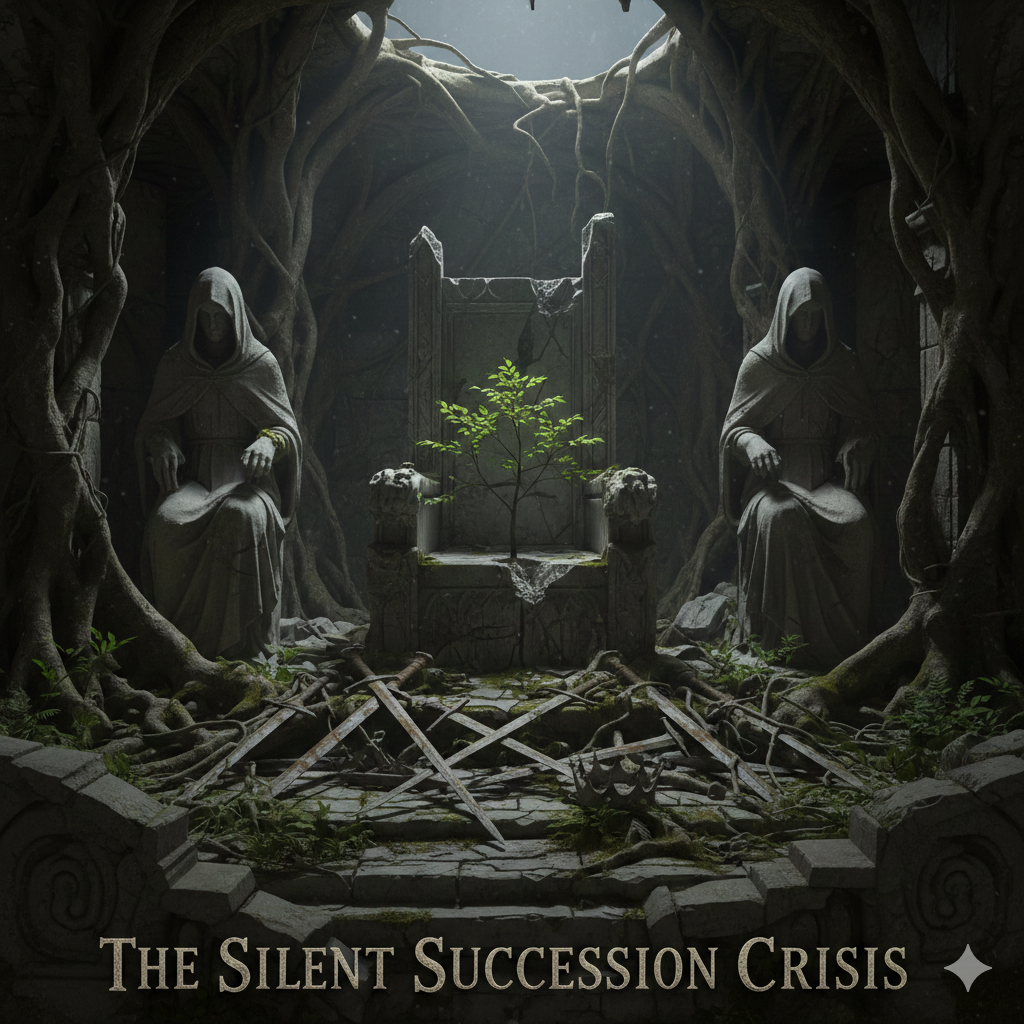

Walk down the main street of any small town or through an industrial park on the outskirts of a city, and you’ll see them. The businesses that have been humming along for decades. The auto shop with the founder’s name still on the sign, now faded. The specialized printing company with machinery that tells a story of another time. The local manufacturing firm that quietly supplied parts to bigger industries. These are the boomer-built enterprises, the tangible results of a lifetime of sweat, risk, and devotion. They are often solid, profitable, and community-anchored. And yet, a quiet crisis is unfolding as their founders look toward retirement: a striking number of their children do not want to take over.

This isn’t a simple tale of failure or obsolescence. In many cases, the business model itself remains perfectly valid. The company solves a real problem, serves a loyal customer base, and generates steady income. The machinery, though not digital, still works with reliable precision. The client relationships are deep and personal. The problem isn’t that the model is broken; it’s that it holds little appeal for the next generation, leading to a strange economic purgatory where viable businesses languish, not for lack of opportunity, but for lack of an interested heir.

The reasons for this reluctance are a tapestry of modern life. The children of these founders often pursued higher education, landing them in different fields—in tech, in creative industries, in corporate roles far from the grit and grind of the family trade. Their aspirations were shaped in a world valuing flexibility, remote work, and global connectivity, not the physical and geographical anchor of a brick-and-mortar enterprise. They witnessed firsthand the all-consuming nature of running a small business—the late nights, the financial worries, the inability to ever truly clock out. Many chose a different kind of stability, one with defined hours and a separation between work and life that their parents never knew.

Furthermore, the emotional weight of succession is immense. Taking over isn’t just a job change; it’s stepping into a legacy, often with a parent reluctant to fully relinquish control. The shadow of the founder can be long, making innovation feel like criticism. The pressure to steward a lifetime’s work, and perhaps the livelihoods of longtime employees who feel like family, is a burden many millennials and Gen-Xers are unwilling to shoulder. They love their parents, but they don’t love the business in the same way.

So we are left with a landscape dotted with these “zombie” businesses—alive and operational, but with an uncertain future. The models are valid. The town still needs a good mechanic. Manufacturers still need reliable suppliers. But the adoption of that life path has plummeted. This creates a paradoxical opportunity for outsiders, for those without the emotional baggage but with an eye for value. The successor of today might not share the founder’s last name. It might be a key employee who finally gets the chance to own, a competitor looking to expand, or a new entrepreneur from outside who sees the hidden gem beneath the layers of tradition and fatigue.

For the boomer owner facing this reality, the path forward requires a clear-eyed shift from seeing the business as a child to be inherited to viewing it as an asset to be transitioned. This means professionalizing operations, cleaning up the books, and perhaps most painfully, detaching personal identity from the company’s day-to-day. It might mean selling to that loyal manager or seeking a merger. It is an act of preservation, ensuring that a model that works can find new energy under new ownership.

The great business handoff is, in many ways, a clash of two very American dreams. One dream was about building something lasting from the ground up, a monument to personal effort. The other is about personal freedom, autonomy, and crafting a life not defined by a single, all-consuming venture. That many viable businesses now sit in the gap between these two dreams is one of the most significant, unspoken shifts in our economy. It reminds us that a business is more than its balance sheet; it’s a story. And sometimes, the next chapter is written by a completely different author.